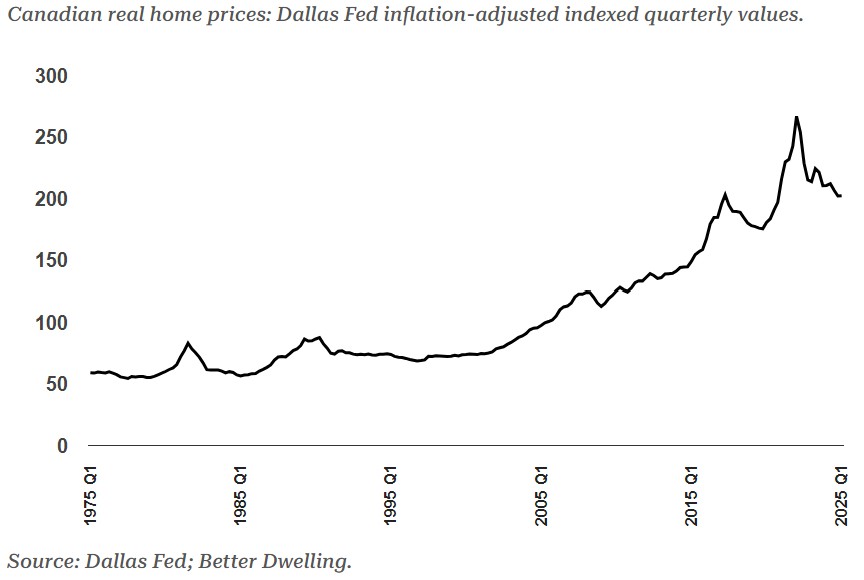

Canadian real estate is not only heading into a cooler fall, but an even cooler set of real estate market conditions and I don’t think the general public has been kept in-the-know, so we’ll be diving into the why and how today. While everyone was busy touting the durability of the market, real, inflation-adjusted home prices have been in what some would call a “free-fall” since hitting a record high three years ago in March/April 2022. According to the US Federal Reserve Bank of Dallas (Dallas Fed), we’re in the middle of the second-largest price correction ever, and it’s, realistically, far from over.1

While we saw a tiny 0.15% real price bump in the first quarter of 2025, prices are still overall 3.94% lower than they were last year1. In inflation-adjusted terms, homes are now cheaper than they were in 2017—a fact that would be a lot more helpful if household wages had managed to keep up with inflation since then.

So what does that mean? Have we hit rock bottom? Are we on our way back up again? Nope, not according to the data, which is still too fresh to be certain and is likely due to be revised again over time as home sales continue to flatline in some areas, weaken in others and see slight increases in some areas.

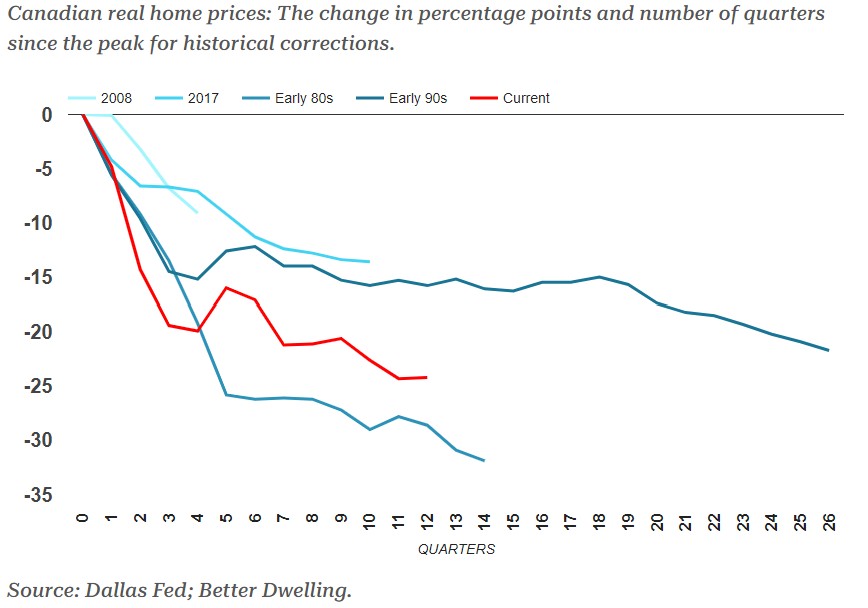

What is clear is that this is one of the biggest real estate corrections on record, which of course, is in relation to one of the largest price soars we have seen in recent history. Prices have plummeted over all 24.18% since their peak in Q1 2022. Now, that’s still shy of the early ’80s crash (-31.92%), but it’s already surpassed the early ’90s correction (-21.7%)1. And the speed of this collapse is rapid, causing all kinds of hesitation in the market.

This correction is now 12 quarters deep, just three years from the peak and when we look back at history, there were only two that were shorter: the 2008 Global Financial Crisis (4 quarters) and the 2017 foreign buyer mini-bubble (10 quarters)1. In comparison, those two were just a blink in the market, although catastrophic in their own rights. The ’08 drop was brief because Toronto had only just recovered from the early ’90s slump, and the 2017 downturn was a flash in the pan before the market froze into the pandemic.

The only two corrections in recent history that compare in scale both lasted longer. The early ’80s crash was 14 quarters (a touch further along than where we are at now)— this was relatively short when you take into consideration the damage that hit the economy and people’s lives. The early ’90s correction, on the other hand, dragged on for 26 quarters, a clear depression in the housing market that was only just recently forgotten in the last few decades with the bold rise in housing demand and prices. In the ’90s, policymakers at the time tried to offset the losses with rapid immigration and financial stimulus (not all too unlike what we are seeing happen in today’s political medling), but, sad to say, all it did was prolong the pain and delay the market reset that was desperately needed to help folks get back on their feet and have confidence in investing all their hard earned dollars into that life long dream of home-ownership.

The current market is still in flux and regional variations exist for every area, not to mention seasonal fluctuations in demand, but overall, we are seeing a bit of a depressed market with high inventory, low sales and jaw-dropping deals to be had when the right buyer finds the right property and a motivated seller!

1 https://betterdwelling.com/canadian-real-estate-is-crashing-at-one-of-the-fastest-rates-ever/

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link