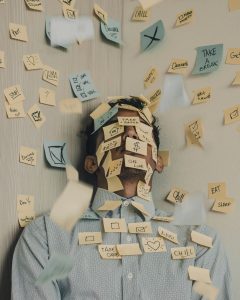

There are a lot of different stressors in the world of real estate right now, particularly for those who are trying to “get in the game” to buy their first home or an investment property. In late 2017, the Canadian government introduced the “stress test” and on June 1, 2021 the Canadian government introduced a little more stress to the lives of those looking to purchase real estate.

**Disclaimer: this is not professional mortgage advice. For particulars of your own financial situation, you should consult with your financial advisor and mortgage broker.**

Now, onto the good stuff.

What is the Stress Test?

The Stress Test was introduced by the Canadian Government in late 2017 as a market control and mortgage-default prevention measure. Essentially the premise was this, ‘make Buyer’s qualify at a higher mortgage interest rate than what they will actually pay so that if/when the interest rates increase, homeowners won’t suddenly find themselves under water and defaulting on their mortgage payments.’ Some logic there, arguably.

Now there are plenty of opinions for and against this move, but that is neither here nor there for today’s discussion. Today we are talking about what the changes to that stress test were and how they might impact you today.

So, what were the changes?

The stress test from 2017 until June 1, 2021 required that you qualify for a mortgage at your given rate plus 2% or at 4.79%, which ever was higher. As of June 1, 2021, all borrowers now have to qualify at the new stress test levels of either your given rate plus 2% or at 5.25% — whichever is higher.

WOWZA!

What does this actually mean for YOU, the Buyer?

Clearly these changes had a large impact on borrowers and their capacity to enter the market. According to the Green Mortgage Team, the change to the Stress Test “decrease[d] borrowing power by approximately 4% to 4.5%,”[1] depending on the purchaser’s specific situation.

What should you do?

What should you do?

You could buy a bucket of ice cream, close all the blinds in your house, put on some Adele and eat your sorrows away… or you can call your mortgage broker and find out exactly how the stress test affects you and if there are any measures that you can take to counteract the increased Stress Test rates and still achieve your real estate goals.

If you don’t currently have a mortgage broker and are thinking about getting into the market, call me or your Realtor and we will be able to direct you to some stellar Mortgage Brokers who can help give clarity to what these qualification rules mean, specifically, for you!

[1] https://www.greenmortgageteam.ca/mortgage-stress-test/

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link